Key Takeaways:

- Access to larger loan amounts: Professional loans for new construction provide access to larger loan amounts, allowing for the construction of larger and more complex buildings.

- Flexible repayment options: Professional loans for new construction offer flexible repayment options, enabling borrowers to choose repayment terms that suit their financial situation and project timeline.

- Expert guidance and support: When securing a professional loan for new construction, borrowers benefit from expert guidance and support from lenders who understand the unique challenges and requirements of construction projects.

Photo Credits: Build-Wire.Com by Lawrence Hernandez

For new construction projects, careful planning and funding is key for success. Professional loans can make a huge impact on helping developers and builders reach their goals.

These loans give the funds needed to start and finish construction projects promptly and within budget. So that the effort can go smoothly.

By using professional loans for new construction, developers can get the money to get land, cover building costs, and manage any unexpected costs that could come up. These loans are made for building projects, with flexible payment terms and competitive interest rates.

With professional loans, developers can focus on creating quality structures that make the most of the building. Whether it’s a residential complex, commercial office space, or industrial facility, these loans can help bring the vision to life.

Also, professional loans for new construction give developers financial stability to get the required permits and licenses, hire qualified contractors, and get quality building materials. This way, projects can move ahead quickly, avoiding delays and finishing on time.

Plus, these loans often come with value-added services like project management support and technical expertise. Lenders with construction industry experience can provide guidance and advice throughout the process, to make sure projects follow regulations and best practices.

In short, professional loans for new construction are essential for making the most of building projects. They provide the financial resources, flexibility, and support developers need to create successful structures. With these loans, developers can begin their construction journey knowing they have the funds and expertise to make their vision happen.

What are professional loans for new construction?

Photo Credits: Build-Wire.Com by Logan Rivera

Have a project to build? Professional loans for new construction can provide the funding. Professional lenders specialize in financing building projects. The loan helps people maximize their building potential. It covers expenses like land, permits, contractors and materials.

The loan has specialized terms and conditions. Funds are released in stages as the construction progresses. This helps manage expenses.

Pro Tip: Have a solid plan before applying. Lenders evaluate the project and the borrower’s ability to repay. A realistic plan increases the chances of getting the loan.

Advantages of professional loans for new construction

Photo Credits: Build-Wire.Com by Jack Hernandez

With professional loans for new construction, you can unlock numerous advantages that will maximize your building potential. From gaining access to larger loan amounts to benefiting from flexible repayment options, these loans provide the necessary financial support for your construction project. Additionally, you can expect expert guidance and support throughout the loan process, ensuring that every step of your new construction venture is well-guided and successful.

Access to larger loan amounts

Professional loans for new construction provide borrowers with greater loan amounts, giving them an edge. Borrowers can customize repayment plans to fit their financial situation and project needs. This ensures they can manage loan payments while attending to other financial obligations.

Obtaining a professional loan for new construction also brings expert help throughout the application process. Lenders specializing in these loans have extensive knowledge of the construction industry. They assist borrowers in meeting requirements and getting the best loan terms and conditions.

To maximize building potential, start by creating a realistic budget. Take into account materials, labor, permits, and any additional costs that come up during construction. With this budget, borrowers can decide on an appropriate loan amount.

Pro Tip: Get personalized advice and strategies from a financial advisor. This can help navigate the complexities of securing a loan.

Professional loans give borrowers flexibility with their repayment options, helping to fit their needs. They can access larger loan amounts to meet the financial demands of their projects.

Flexible repayment options

A professional loan for new construction offers flexible repayment options. Borrowers can select from shorter or longer terms, adjustable interest rates, deferred payments, prepayment privileges, and interest-only payments. Plus, grace periods or extensions on repayment deadlines may be offered.

It is important for borrowers to carefully consider their financial objectives before selecting a repayment option. Consulting a financial advisor may help to determine which option aligns best with their goals and current circumstances.

Expert guidance and support

Expert guidance and support come with professional loans for new construction. Access a team of professionals who offer advice and assistance to navigate the complexities of building projects. Get advice on selecting materials, coordinating with contractors, and managing timelines.

Professionals possess extensive knowledge and experience in the industry. Offer valuable insights and recommendations to make informed decisions at every step of construction.

Unexpected challenges may arise. Professionals are equipped to handle them and offer alternative solutions or strategies. Borrowers can proceed with confidence knowing they have a skilled team guiding them.

In summary, professional loans not only provide financial resources but also expert guidance and support. Rely on professionals’ knowledge and experience to make informed decisions, address challenges, and ultimately achieve successful outcomes.

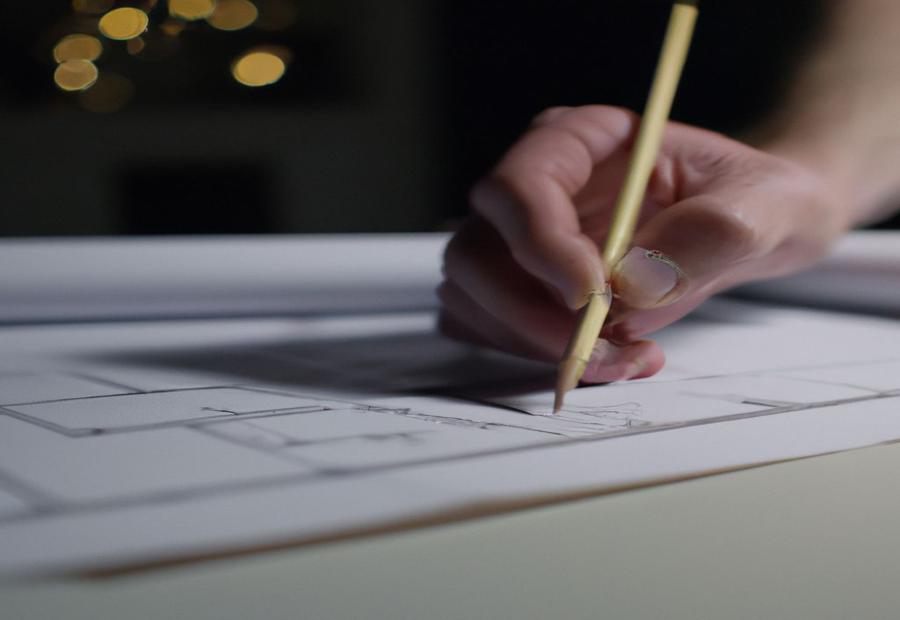

Requirements for securing a professional loan for new construction

Photo Credits: Build-Wire.Com by Austin Baker

To secure a professional loan for new construction, there are essential requirements that need to be met. These include hiring a reputable and licensed builder, providing a detailed construction plan, going through the appraisal process, determining the loan amount, considering down payment options, and demonstrating proof of income and credit score. By exploring these sub-sections, we can understand the crucial factors involved in maximizing your building potential with professional loans for new construction.

Hiring a reputable and licensed builder

When it comes to hiring a trustworthy and licensed builder, there are several points to remember.

Take into account the builder’s expertise and practice in the particular type of development you need. Different builders have various specializations like residential homes, commercial buildings, or industrial complexes.

Selecting a builder with relevant experience in your desired project means you can benefit from their know-how and skill-set.

Apart from experience and expertise, lenders may also ask for documents about the builder’s qualifications. Such papers can include evidence of licensing, certifications, insurance coverage, and references from past customers. Thoroughly screening potential builders is important as it makes sure you are picking someone competent and reliable.

By getting a reputable and licensed builder for your new construction project, you can reduce risk and enhance your prospects of getting a professional loan. Lenders view reliable builders as dependable collaborators, who are more likely to finish projects on time and within budget. This advantageous perception gives lenders confidence in providing higher amounts for new construction projects. In the end, working with a reputable builder can improve your credibility in the eyes of lenders and boost your odds of getting financing for your project.

Providing a detailed construction plan

It is essential to have a detailed construction plan when attempting to secure a professional loan for new construction. This plan provides the lender with a complete overview of the project, including the scope of work, materials needed, and estimated costs.

By having a detailed construction plan, borrowers can show their preparedness and better their chances of getting the desired loan amount. Here are some guidelines for creating an effective construction plan:

- Hire a reputable and licensed builder;

- Specify the scope of work;

- Determine materials and cost estimates;

- Present the plan in a clear layout.

Following these steps will give you the best chance of successfully obtaining the loan for your new construction project. Providing a comprehensive and well-thought-out construction plan is essential when applying for a professional loan for new construction. It demonstrates professionalism and gives the lender confidence in your capability to manage the project. Accurate appraisals are important for both relationships and loan applications.

Appraisal process and determining the loan amount

The appraisal process is vital for working out loan amounts for new construction projects. It involves a comprehensive evaluation of the property to decide its worth. This assessment is necessary for lenders to decide the maximum loan amount that can be given.

Five points must be looked at when determining the loan amount. Firstly, a licensed appraiser assesses the location, size, condition, and amenities of the property. They also look at similar properties in the area to get a precise valuation.

Market analysis is another important part of the appraisal process. The appraiser studies recent sales data of comparable properties in the neighborhood. This helps set a baseline value for the property that is being loaned for.

The appraiser takes into account both current and projected construction costs. This includes materials, labor, permits, and other expenses related to the construction process. Considering these costs is vital for working out the loan amount.

The appraisal also considers potential market appreciation and demand for similar properties in the future. This makes sure lenders have confidence in the long-term value and legitimacy of the project.

Collaboration with loan providers is needed throughout the appraisal process. The lender works together with the borrower and appraiser to make sure an exact valuation is achieved. This cooperative approach allows for open communication and eliminates any discrepancies about loan amounts.

To get an accurate appraisal value, the builder’s experience and overall reputation must be considered. Also, providing details about construction plans, financial stability, proof of income, and credit score, as well as showing the ability to make timely repayments, can increase the chances of getting a professional loan for new construction projects.

In short, the appraisal process is very important for working out loan amounts for new construction projects. By looking at the evaluation by a licensed appraiser, conducting market analysis, taking construction costs into account, assessing future value, and collaborating with loan providers, an exact valuation can be reached.

Down payment and loan repayment ability

For a successful loan for new construction, borrowers must have a significant down payment. This indicates strong loan repayment abilities and reduces the lender’s risk. Also, good credit and stable income are beneficial. To increase the chances of getting a professional loan, save for a big down payment and maintain a great credit score!

Proof of income and credit score

Secure a professional loan for new construction by providing proof of income and an impressive credit score. These are crucial to assessing the borrower’s ability to repay the loan and the level of risk involved.

- Proof of income establishes financial stability.

- Higher income = better capacity to repay.

- Steady income reassures lenders.

- Credit score reveals responsible financial behavior.

- Income helps decide loan amount.

- Credit scores help determine loan terms.

Other factors to consider: additional debts, financial liabilities. Be transparent with the lender and provide any necessary documents right away. This boosts your chances of getting the loan.

Maximize building potential – get a professional loan for new construction!

How to maximize your building potential with a professional loan

Photo Credits: Build-Wire.Com by Willie Rivera

Learn how to unlock your building potential with a professional loan. Discover essential tips and strategies for maximizing your construction project’s success. From establishing a realistic budget to working with financial advisors, and identifying the right loan terms and options, we’ll guide you through the crucial steps. Additionally, we’ll help you navigate the process of researching and comparing loan providers to ensure you make informed decisions. Get ready to elevate your building project with professional loans.

Establishing a realistic budget

Creating a realistic budget for new construction projects needs professional loans. Consider immediate and long-term financial implications. Understand financial resources and decide how much to allocate. Research average cost of construction in the area and factor in permits, inspections, and utility connections. Check loan options available. List all expenses in categories. Think about future maintenance costs. Monitor and adjust budget regularly. Take steps to develop a budget plan tailored to your needs. This way you can pursue building goals responsibly.

Working with a financial advisor

Collaborating with a financial advisor is essential when getting a professional loan for new construction. They have comprehensive knowledge of the financial industry and can give helpful advice throughout the loan process.

Financial advisors can help borrowers comprehend the many terms and options available. They can assess the borrower’s finances and objectives to decide the best loan terms and repayment plans. These advisors can also spot potential risks during construction, ensuring borrowers are ready.

Plus, they can assist with making a budget for the construction. They can assess the costs of materials, labor, permits, and other expenses, so borrowers can understand their financial obligations. By working with an advisor, individuals can make wise decisions about their loan amount and not overspend.

In conclusion, having a financial advisor is vital for getting the most out of a professional loan for new construction. They offer expertise in loan applications, suitable loan terms, and budgeting. Leveraging their guidance, borrowers can have a smooth loan process and reach their construction goals.

Identifying the right loan terms and options

Locating the ideal loan terms and options is vital when getting a professional loan for new construction. Weighing up various factors, such as interest rates, repayment terms and bonus features offered by lenders is key. Comparing these options allows borrowers to decide which loan works best for their needs and financial situation.

Research and assess loan terms to make an educated decision. This includes being aware of the various loan types, e.g. fixed-rate or adjustable-rate mortgages, loan term length and penalties for early repayment.

Furthermore, compare interest rates from different lenders, considering both the initial rate and any possible changes over time. Plus, consider any fees or additional costs, such as origination fees or prepayment penalties.

The balance between affordability and flexibility must be found to manage loan payments and achieve construction objectives. For this, long-term financial implications need to be taken into account.

According to ‘Maximizing Your Building Potential With Professional Loans for New Construction,’ correctly evaluating loan terms is paramount in securing a professional loan for new construction. So, find the right lending match for your wallet – like speed dating!

Researching and comparing loan providers

When researching for a new construction project loan, it’s important to naturally incorporate all keywords. Here are some steps to guide you:

- Assess the reputation and credibility of each lender.

- Compare interest rates, fees, and terms.

- See what loan amounts are available and if they fit your financial needs.

- Evaluate the customer support quality they offer.

- Analyze the application process, requirements, and timelines.

- Ask friends, family, or professionals for loan recommendations.

- Check for any unique features or benefits they may offer.

- By researching lenders’ historical information and reviews, you can maximize your chances of finding the best loan provider.

Conclusion and final tips for success in obtaining a professional loan for new construction

Photo Credits: Build-Wire.Com by Jeffrey Smith

Professional loans for new construction can be a great boost to any building project. They supply the capital needed for construction, helping you to bring your dream to life. Here are some tips for obtaining a loan for new construction.

- Firstly, plan carefully. Lenders want to know that you’ve thought about every aspect of the project, such as costs, timelines and risks. A comprehensive plan will assure them.

- Secondly, have a strong financial profile. Lenders will assess your credit score, income stability and existing debts. Demonstrate financial responsibility and stability.

- Thirdly, build a positive relationship with lenders. Keep communication open, provide updates on the project, and be honest about any challenges. This will create trust and increase your chances of getting a loan.

In summary, plan well, have a solid financial background, and communicate clearly with lenders. This will help you get the necessary funding and maximize your project’s potential.

Some Facts About Maximizing Your Building Potential With Professional Loans for New Construction:

- ✅ Construction loans are specifically designed to finance building costs for new homes or renovation projects. (Source: Team Research)

- ✅ Unlike standard mortgages, construction loans have different requirements that must be fulfilled. (Source: Team Research)

- ✅ To secure a construction loan, hiring a reputable and licensed builder with a proven track record is a necessary requirement. (Source: Team Research)

- ✅ Providing a detailed description of the construction plan, known as the “blue book,” is required when applying for a construction loan. (Source: Team Research)

- ✅ A sizable down payment, typically at least 20%, is necessary to demonstrate commitment to the project and protect the lender. (Source: Team Research)

FAQs about Maximizing Your Building Potential With Professional Loans For New Construction

What is a construction loan and how is it different from a standard mortgage?

A construction loan is a type of loan specifically designed to finance the building costs for a dream house or renovation project. It differs from a standard mortgage in its requirements and purpose. While a standard mortgage is used to purchase a completed home, a construction loan is used to fund the construction process itself.

What are the requirements for obtaining a construction loan?

To secure a construction loan, you need to fulfill several necessities. One requirement is hiring a reputable and licensed builder with a proven track record. If you plan to build the house yourself or hire an amateur builder, it may be difficult to find a lender to finance the project. Additionally, providing a detailed description of the construction plan, commonly referred to as the “blue book,” is essential. This blue book should include information on the timeline, floor plans, insulation, cost of materials, and profit projections. Proof of income, a good credit score, and a sizable down payment are also necessary to demonstrate your ability to repay the loan and show commitment to the project.

Why is the “blue book” important for a construction loan?

The “blue book” is a crucial part of obtaining a construction loan. It provides a comprehensive description of the construction plan, including details on timeline, floor plans, insulation, cost of materials, and profit projections. This information helps the lender assess the feasibility and potential value of the project. It also lists the suppliers and subcontractors involved in the construction, ensuring transparency and accountability.

What role does an appraisal play in the construction loan process?

An appraisal is necessary for a construction loan to determine the value of the end product. A licensed appraiser considers the information provided in the “blue book” and compares it to similar houses and projects in the area. This assessment helps the lender determine the loan amount and ensure it aligns with the estimated value of the completed construction.

Why is a sizable down payment required for a construction loan?

A sizable down payment, typically at least 20% but sometimes up to 25%, is required for a construction loan. This down payment serves multiple purposes. Firstly, it demonstrates the borrower’s commitment to the project and reduces the lender’s risk. Secondly, it provides a form of collateral, protecting the lender in case the project’s value is lower than initially estimated. A substantial down payment also helps lower the loan amount and subsequent monthly payments.

Why is it important to work with a qualified builder when obtaining a construction loan?

Working with a qualified builder is essential when seeking a construction loan. Lenders require hiring a reputable and licensed builder with a proven track record. This requirement ensures expertise, experience, and adherence to construction regulations, minimizing the risks associated with the project. A qualified builder helps maximize the chances of completing the construction successfully and within the agreed timeline.