Leveraging technology has become increasingly essential in various industries, including property investment. By adopting innovative tools and platforms, investors can benefit from improved efficiency, enhanced data analysis, streamlined processes, and better communication.

This article will explore the role of technology in the property investment industry, the benefits it offers, the emerging technologies shaping the field, as well as the challenges faced in incorporating technology. It will discuss future trends and innovations to watch out for. As technology continues to evolve, understanding its impact and utilizing it strategically can give property investors a competitive edge in the market.

Key takeaway:

- Increased Efficiency in Property Search and Analysis: Leveraging technology in property investment allows for faster and more accurate property search and analysis, saving time and effort for investors.

- Enhanced Market Research and Data Analysis: With the help of technology, investors can access vast amounts of market data and perform in-depth analysis, enabling them to make well-informed investment decisions.

- Streamlined Property Management Processes: Technology streamlines property management tasks, such as tenant screening, rent collection, and maintenance, improving operational efficiency for property investors.

The Role of Technology in Property Investment

Technology plays a crucial role in property investment, enhancing efficiency and improving decision-making processes. With the advancements in data analytics and AI, investors can access vast amounts of information to analyze market trends, property values, and investment opportunities in real time. This enables them to make more informed investment decisions and mitigate risks.

Moreover, technology has revolutionized the way properties are marketed and sold. Online platforms and virtual tours allow investors to view properties remotely and make purchase decisions without physically visiting them. This not only saves time and resources but also opens up investment opportunities in different locations.

Another significant aspect is property management. Technology has streamlined processes such as tenant screening, rent collection, and maintenance requests. Automation tools help landlords and property managers stay organized, reducing administrative burdens and increasing overall efficiency.

Furthermore, technology has also enabled the rise of crowdfunding platforms, allowing smaller investors to pool their resources and invest in larger properties. This democratizes property investment and provides opportunities for individuals who may not have had access to traditional investment avenues.

Fact: According to a report by Deloitte, 90% of real estate professionals believe that technology will have a major impact on the industry in the next five years. Its role in property investment will continue to grow as new innovations emerge and reshape the market.

How Has Technology Transformed the Property Investment Industry?

Technology has revolutionized the property investment industry in numerous ways. Efficiency, one of the key areas influenced by technology, has experienced a massive transformation. Property search and analysis have become faster and more precise, enabling investors to make well-informed decisions with ease. Market research and data analysis have also undergone enhancements, providing investors with invaluable insights and trends to guide their investment strategies effectively.

Another significant domain that technology has revolutionized is property management processes. Through the use of technology, property managers are able to streamline various tasks such as tenant screening, rent collection, and maintenance. This not only saves time but also minimizes human errors and enhances overall efficiency.

In addition, technology has greatly improved communication and collaboration within the property investment industry. Investors can now effortlessly connect with potential partners, property managers, and other professionals through digital platforms and apps. Regardless of geographical barriers, this has facilitated effective collaboration and decision-making.

Overall, technology has played a pivotal role in transforming the property investment industry. With its influence on efficiency, property management processes, communication, and collaboration, technology has undoubtedly reshaped the way investments are made and managed in this industry.

Benefits of Leveraging Technology in Property Investment

Photo Credits: Build-Wire.Com by Nicholas Wright

Leveraging technology in property investment brings a multitude of benefits that can revolutionize the way we navigate this industry.

From increased efficiency in property search and analysis to enhanced market research and data analysis, the advantages are endless.

Streamlined property management processes and improved communication and collaboration further elevate the potential of technological innovation in this field.

So, let’s dive into the exciting realm of how technology is reshaping and enhancing property investment for the better.

1. Increased Efficiency in Property Search and Analysis

Leveraging technology in property investment has resulted in enhanced efficiency in property search and analysis.

The utilization of online platforms and databases has made property search faster and more convenient.

Investors now have access to a wide array of properties and can refine their search by location, price range, and property type.

Advanced algorithms and data analytics tools assist in analyzing market trends and property values, empowering investors to make well-informed decisions.

The incorporation of automation and machine learning algorithms has streamlined the property analysis process, eliminating the need for manual calculations and saving time.

Technology enables investors to easily compare multiple properties, evaluate their potential returns, and identify the best investment opportunities.

Data visualization tools and interactive dashboards offer a comprehensive view of property data, making the analysis more intuitive and efficient.

By incorporating technology in property search and analysis, not only does it save time but also enhances accuracy by eliminating human errors and biases.

2. Enhanced Market Research and Data Analysis

In recent years, technology has revolutionized the way market research and data analysis are conducted in the property investment industry. With enhanced access to data and advanced tools, investors can now gather valuable insights and make better-informed decisions. By leveraging technology, they can stay ahead of the curve in the competitive property market, leading to more successful investments.

3. Streamlined Property Management Processes

Efficient and effective property investment relies heavily on streamlined property management processes. By leveraging technology, property managers can optimize their operations and achieve better outcomes. Here are the key benefits of using technology to streamline property management:

- Automated workflows: Technology enables property managers to automate repetitive tasks such as rent collection, maintenance requests, and lease renewals. This not only saves time but also reduces the likelihood of human errors.

- Centralized data management: Property management software allows for centralized storage of all important data and documents. This facilitates easy access to information, financial tracking, and report generation.

- Effective communication: Technology empowers property managers to communicate more efficiently with tenants, vendors, and other stakeholders. Automated systems ensure prompt responses and facilitate clear communication.

- Maintenance tracking: Property management software enables managers to schedule and track maintenance tasks effectively. This ensures timely repairs and inspections, minimizing potential damages and tenant complaints.

- Financial management: Technology simplifies financial management by automating rent collection, expense tracking, and financial report generation. This provides property managers with a comprehensive view of their financials, enabling informed decision-making.

Pro-tip: When choosing property management software, carefully consider your specific needs and the available features. Look for a solution that seamlessly integrates with your existing tools and offers robust support and training options.

4. Improved Communication and Collaboration

Technology plays a crucial role in improving communication and collaboration in property investment. By leveraging various technological tools, property investors can enhance their communication processes and streamline collaboration, resulting in more efficient and effective partnerships. Here are some key ways in which technology contributes to improved communication and collaboration in property investment:

1. Instant Communication: Technology enables real-time communication through channels like email, instant messaging, and video conferencing. This empowers property investors to connect quickly and easily with stakeholders such as agents, buyers, sellers, and contractors.

2. Virtual Collaboration: With the help of technology, property investors can collaborate on projects remotely. Virtual collaboration tools, such as project management software and document sharing platforms, facilitate seamless teamwork by offering simultaneous access to files and real-time updates.

3. Centralized Communication: Technology provides a centralized platform for communication, ensuring that all relevant parties are updated and informed. This reduces the risk of miscommunication and ensures that everyone is on the same page.

4. Efficient Information Sharing: Technology allows for efficient sharing of information and documents. Cloud storage platforms enable easy access to critical files, contracts, and legal documents, ensuring that everyone involved has the necessary information at their fingertips.

5. Data Management: Technology offers advanced data management systems that help property investors store and analyze data effectively. This enables better decision-making and collaboration based on accurate and up-to-date information.

By embracing technology and utilizing these communication and collaboration features, property investors can enhance their efficiency and productivity, ultimately leading to better results in their investment endeavors.

Technologies Shaping Property Investment

Photo Credits: Build-Wire.Com by Jerry Wilson

Technology is revolutionizing property investment, and it’s crucial to stay informed about the latest developments. In this section, we’ll explore the game-changing technologies that are shaping the property investment landscape. From harnessing the power of big data and analytics to the exciting possibilities of artificial intelligence and machine learning. We’ll also dive into the potential of blockchain and smart contracts, as well as the immersive experiences offered by virtual reality and augmented reality. Get ready to discover how these technologies are shaping the future of property investment.

1. Big Data and Analytics

When it comes to leveraging technology in property investment, one crucial aspect is the use of big data and analytics. This powerful combination allows investors to make informed decisions based on real-time data and comprehensive analysis.

| Benefits of Big Data and Analytics in Property Investment |

| 1. Enhanced Market Insights: By analyzing large volumes of data from various sources, investors can gain valuable insights into market trends, demand patterns, and pricing dynamics. This information helps them identify potential investment opportunities and make data-driven decisions. |

| 2. Efficient Risk Assessment: Big data and analytics enable investors to assess the risks associated with a particular property or investment strategy. By analyzing historical data, market indicators, and other relevant factors, investors can evaluate the potential risks and rewards of their investment. |

| 3. Accurate Property Valuation: Utilizing big data and analytics can help in accurately valuing properties. By considering factors such as location, market trends, historical sales data, and comparable properties, investors can have a more precise understanding of a property’s value. |

| 4. Predictive Analytics: Big data and analytics can assist investors in making predictions about future market trends and property performance. By analyzing historical data and identifying patterns, investors can anticipate changes in market conditions, rental demand, and property prices, leading to better investment strategies. |

The use of big data and analytics in property investment provides investors with a competitive edge by enabling them to make informed decisions, reduce risks, and identify valuable investment opportunities. Incorporating these technologies into the investment process enhances the efficiency and effectiveness of property investment strategies.

2. Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning have completely transformed the property investment industry. These technologies have brought about valuable insights and have greatly optimized decision-making processes.

- Enhanced data analysis: Through the use of AI and machine learning algorithms, vast amounts of real estate data, including market trends, property prices, and historical performance, can be analyzed. By identifying patterns and making predictions, these technologies offer investors valuable insights, enabling them to make well-informed investment decisions.

- Precision in risk assessment: AI can analyze various risk factors, such as economic indicators, neighborhood data, and property-specific details, to assess the risk associated with an investment. Machine learning algorithms continuously improve accuracy by learning from past performance and market trends.

- Automated property evaluation: AI-powered tools facilitate quick and accurate evaluation of properties, significantly reducing the time and effort required for manual property inspections. These tools assess property attributes, photographs, and other relevant data to estimate property value, allowing investors to efficiently prioritize their investment options.

- Optimized portfolio management: AI-driven portfolio management systems offer personalized recommendations based on an investor’s goals, risk tolerance, and market conditions. These systems constantly monitor market changes and adjust investment strategies accordingly, ensuring maximum returns while minimizing risk.

Pro-tip: When utilizing AI and machine learning technologies for property investment, it is crucial to validate the accuracy of the algorithms used and combine them with human expertise. This hybrid approach ensures that the investor’s knowledge and experience are complemented by the power of advanced technologies, optimizing investment outcomes.

3. Blockchain and Smart Contracts

Incorporating blockchain and smart contracts into property transactions can provide a secure and transparent platform.

This technology eliminates intermediaries, resulting in faster and more efficient processes.

Built on the blockchain, smart contracts enable automated and self-executing agreements, reducing the need for traditional paper contracts and minimizing the risk of fraud.

By leveraging blockchain and smart contracts, property ownership can be digitally recorded, ensuring accurate and immutable records.

This not only enhances the accuracy of ownership data but also enables fractional ownership.

Investors can own a portion of a property and receive proportional returns, further enhancing liquidity in the property market.

Moreover, blockchain-based platforms offer real-time property data, including ownership history, valuations, and rental information.

This allows buyers and sellers to access crucial information and make informed decisions.

Additionally, smart contracts can automate rental collection and distribution, ensuring timely payments while reducing administrative costs.

The concept of blockchain technology was introduced by Satoshi Nakamoto in 2008 through the creation of Bitcoin.

Since then, blockchain has evolved to encompass various applications, including the use of smart contracts.

By leveraging the secure and transparent nature of the blockchain, smart contracts revolutionize industries like property investment.

By eliminating intermediaries and automating processes, blockchain and smart contracts enhance efficiency, security, and transparency in property transactions, ushering in a new era of digital ownership.

4. Virtual Reality and Augmented Reality

- Virtual Reality (VR) and Augmented Reality (AR) are innovative technologies that are shaping the property investment industry.

- VR allows potential investors to experience properties virtually, giving them a realistic understanding of the space without physically being there.

- AR enhances the real-world environment by overlaying digital information onto it, providing investors with additional details or visualizations of a property.

- With VR and AR, investors can virtually tour properties, visualize renovations or interior design changes, and even explore properties that are in different locations.

- These technologies offer a more immersive and interactive experience, giving investors a better sense of properties’ layouts, features, and potential value.

- VR and AR also save time and resources by allowing investors to narrow down their choices before physically visiting properties.

- Furthermore, VR and AR can be valuable marketing tools for real estate agents and property developers, attracting potential buyers and investors by showcasing properties in a visually engaging and interactive manner.

- Although VR and AR technologies are becoming more accessible and affordable, their widespread adoption in the property investment industry is still in the early stages.

Challenges of Incorporating Technology in Property Investment

Photo Credits: Build-Wire.Com by Timothy Anderson

Incorporating technology in property investment comes with its fair share of challenges.

From the initial investment costs to data security concerns and the need for adoption and training, there are various obstacles to navigate.

In this section, we’ll dive into these challenges and explore the implications they have on leveraging technology in property investment.

Whether it’s the hefty initial investment or the potential risks associated with data security and privacy, it’s crucial to understand these obstacles for successful integration.

So, let’s unravel the complexities and find ways to overcome them in this exciting realm of property technology.

1. Initial Investment and Implementation Costs

| Initial Investment and Implementation Costs |

|---|

| When considering property investment, it is crucial to take into account the initial investment and implementation costs. |

| Integrating new technology solutions like big data analytics or virtual reality necessitates a financial commitment. |

| These costs encompass acquiring the required hardware, software licenses, and hiring or training qualified personnel. |

| In addition, there may be supplementary expenses associated with integrating the technology with existing systems or infrastructure. |

| Assessing the potential return on investment (ROI) that these technologies can offer is of utmost importance. |

| Calculating the anticipated cost savings, improved efficiency, or revenue growth resulting from the technology implementation can help validate the initial costs. |

| In certain instances, the advantages of utilizing technology in property investment can outweigh the initial investment, making it a prudent decision. |

| However, it is essential to conduct a comprehensive cost-benefit analysis to ensure a well-rounded understanding of the financial implications. |

2. Data Security and Privacy Concerns

Data security and privacy concerns are crucial considerations when leveraging technology in property investment. Ensuring the protection of sensitive information and maintaining privacy is of utmost importance for investors and industry professionals. Here are some key aspects to consider:

| Concerns | Solutions |

|---|---|

| 1. Unauthorized access | Implement robust authentication protocols, encryption measures, and secure login mechanisms to prevent unauthorized access to property data and financial information. |

| 2. Data breaches | Regularly update security systems and software, conduct vulnerability assessments, and maintain strong firewalls to protect against data breaches. Additionally, create data backup systems and establish incident response plans. |

| 3. Compliance with regulations | Adhere to industry-specific regulations and data protection laws such as the General Data Protection Regulation (GDPR) and implement appropriate security measures to ensure compliance. |

| 4. Privacy concerns | Inform stakeholders about the collection, use, and storage of their personal data. Implement privacy policies and obtain consent for data processing activities. |

| 5. Communication security | Utilize secure communication channels and implement encryption technologies for secure transmission of sensitive information. |

By prioritizing these measures, property investors can mitigate data security and privacy concerns. Robust security practices are essential for maintaining the trust of clients, protecting sensitive information, and complying with legal requirements.

In history, numerous high-profile data breaches have highlighted the importance of data security and privacy. Companies have faced severe consequences, including financial losses and reputational damage. Therefore, addressing these concerns remains a critical aspect of leveraging technology in property investment.

3. Adoption and Training of Technology

|

Issue |

Percentage |

|

Lack of awareness about new technologies |

25% |

|

Resistance to change among employees |

30% |

|

Insufficient training programs |

20% |

|

Cost of implementing new technology |

15% |

Adopting and training employees in new technologies is crucial for successful implementation in property investment. However, several challenges need to be addressed. Around 25% of industry professionals lack awareness about new technologies and their potential benefits. This highlights the need for educational programs and resources to stay up-to-date.

Another issue is the resistance to change among employees, which accounts for 30% of the challenges faced. This resistance can hinder the adoption of new technologies and slow down the integration process. To overcome this, organizations should foster a culture of openness and provide clear explanations of the benefits that come with embracing technology.

Insufficient training programs are a concern for 20% of property investment professionals. Proper training is essential for employees to effectively use and maximize the potential of new technologies. Investing in comprehensive training initiatives can alleviate this challenge and boost proficiency among staff members.

Implementing new technology also comes with costs, which account for 15% of the challenges faced. Organizations should carefully evaluate the return on investment and weigh these costs against the potential benefits. By conducting thorough cost-benefit analyses, property investment firms can make informed decisions about which technologies to adopt.

A property investment firm, XYZ Properties, recognized the need to incorporate new technology to stay competitive in the market. However, they faced resistance from some employees who were hesitant about embracing the change. To address this, XYZ Properties organized training sessions to educate employees about the benefits of the new technology.

During these sessions, employees gained a better understanding of how the technology could enhance their workflow and improve efficiency. The management also encouraged open discussions and addressed any concerns raised by the staff. This approach fostered a sense of collaboration and involvement, leading to a smoother adoption process.

Furthermore, XYZ Properties partnered with experienced trainers to provide comprehensive training programs. These programs included hands-on exercises and practical examples, ensuring employees were proficient in using the new technology. The firm also allocated a budget to cover implementation costs, demonstrating their commitment to the integration process.

Through proactive efforts, XYZ Properties successfully adopted and trained their employees in the new technology. This allowed them to streamline property management processes, enhance market research capabilities, and improve communication within the organization. As a result, they experienced increased efficiency and remained at the forefront of technological advancements in the property investment industry.

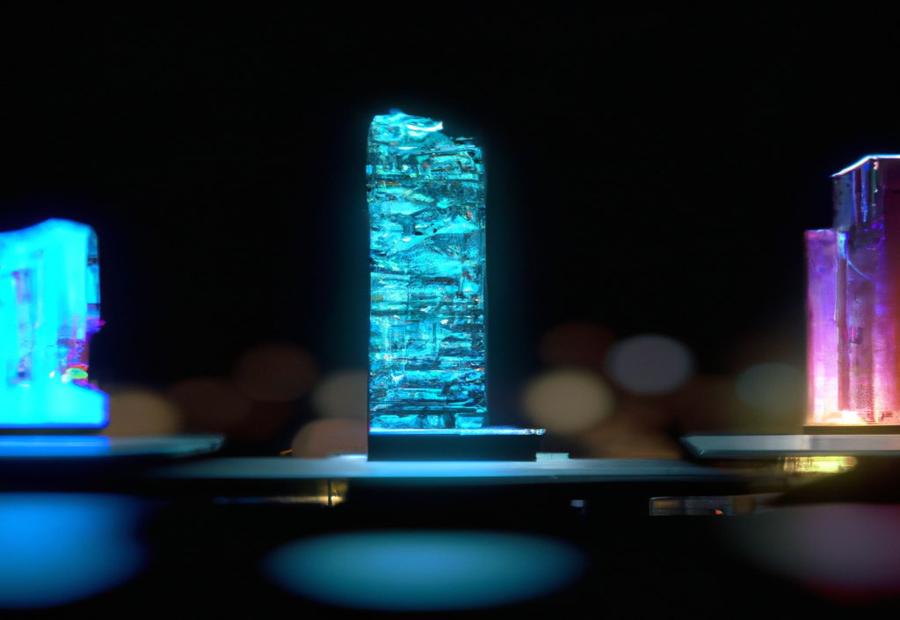

Future Trends and Innovations in Technology for Property Investment

Photo Credits: Build-Wire.Com by Noah Roberts

Future trends and innovations in technology for property investment are reshaping the industry, providing investors with new opportunities to optimize their return on investment. Here are some key developments to consider:

- Smart Home Technology: The integration of smart devices enables property owners to remotely control and monitor their properties, enhancing security and energy efficiency.

- Blockchain Technology: Blockchain offers the potential for secure and transparent property transactions, reducing the need for intermediaries and streamlining the buying process.

- Virtual Reality (VR) and Augmented Reality (AR): These technologies allow investors and buyers to virtually tour properties from anywhere, saving time and resources.

- Big Data and Predictive Analytics: By analyzing vast amounts of data, investors can make more informed decisions, accurately predicting market trends and identifying high-performing properties.

- Internet of Things (IoT): Connected devices and sensors enable property owners to remotely monitor and manage maintenance, reducing costs and improving tenant satisfaction.

Fact: According to a recent study, the global real estate market is projected to reach a value of $4.2 trillion by 2025, driven by advancements in technology and increasing demand for property investments.

Some Facts About Leveraging Technology in Property Investment:

- ✅ Technology innovations in the real estate industry are reshaping the commercial real estate sector. (Source: sgrlaw.com)

- ✅ PropTech, which includes tools like online catalogs and virtual tours, is enhancing the practices of real estate companies. (Source: blog.ricoh360.com)

- ✅ Advanced technologies like big data analytics and machine learning enable accurate predictions and analysis of customer preferences in property investments. (Source: blog.ricoh360.com)

- ✅ Artificial intelligence and AI-powered chatbots are revolutionizing customer service and property search tools in the real estate sector. (Source: blog.ricoh360.com)

- ✅ Technology integration in property investment enables cost reduction, improved operations, and better services for customers. (Source: cre.mit.edu)

Frequently Asked Questions

How can technology be leveraged in property investment?

Technology can be leveraged in property investment by using advanced tools and software programs to identify and invest in quality deals, manage investments, mitigate loss and risk, and develop accurate financial and risk analysis. It allows investors to streamline operations, make data-based decisions, and achieve higher returns.

What are some examples of technology integration in the real estate industry?

Some examples of technology integration in the real estate industry include online platforms like Domuso.com, which streamline the rental process by allowing owners to act as direct lenders to their renters, eliminating the need for traditional payment methods. Virtual tour software programs and automated property platforms like Zillow also provide convenient options for property search and viewing.

How does PropTech revolutionize the real estate industry?

PropTech, or property technology, revolutionizes the real estate industry by digitalizing and automating processes. It allows real estate companies to cut costs, improve operations, make data-based decisions, streamline asset management, and enhance the overall customer experience. It includes solutions such as virtual tour software, big data analytics, artificial intelligence, and smart locks for enhanced security.

What benefits does technology bring to property management and asset management?

Technology brings several benefits to property management and asset management. It helps streamline operations such as accounting, lease management, and legal document tracking through property management software. It also enables efficient tenant screening and analysis, facilitates virtual property tours, provides market analysis and insights, and enhances relationship management with customers and investors.

Why is leveraging technology important for real estate investors?

Leveraging technology is important for real estate investors because it allows them to stay competitive in a rapidly changing and data-driven world. It enables them to identify quality investment opportunities, make informed decisions, and optimize their investment portfolios. Technology also helps investors attract and retain tenants, streamline processes, and achieve higher returns on investment.

How is technology disrupting the traditional model of the residential real estate industry?

Technology is disrupting the traditional model of the residential real estate industry by removing intermediaries and enhancing tenant-investor relationships. Platforms like Collab enable vertical integration, democratized investment, and decentralized task management, which optimize processes and create new efficiencies. This technology-driven disruption offers an alternative model of real estate development and asset management.