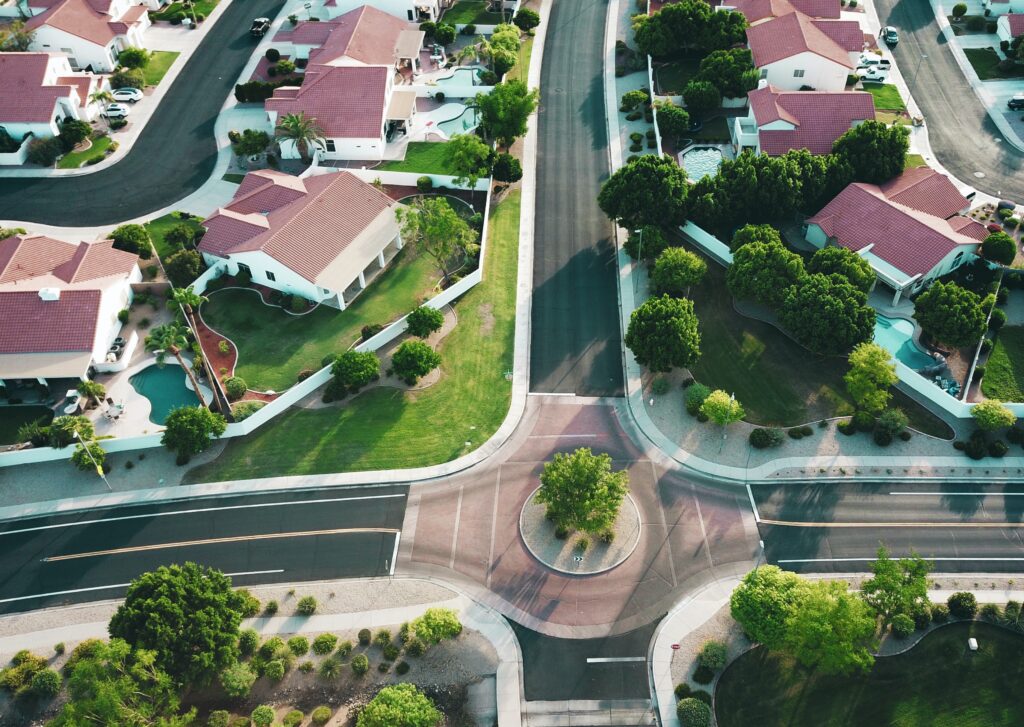

In this article, we will explore whether real estate development is a profitable venture. We will discuss the various factors that contribute to the profitability of this industry, including market trends, location, and investment strategies. Additionally, we will provide insights into the potential risks and challenges faced by real estate developers, and offer tips on how to maximize profitability in this field. Whether you’re considering investing in real estate development or simply curious about its financial viability, this article will provide you with valuable information and perspectives on the profitability of this industry.

This image is property of images.unsplash.com.

Defining Real Estate Development

What is real estate development?

Real estate development is the process of creating and enhancing properties for various purposes, such as residential, commercial, industrial, or mixed-use. It involves acquiring land or existing properties, conducting feasibility studies, obtaining financing, designing and planning, construction, marketing, and sales. Real estate developers aim to generate profit by maximizing the value of the properties they develop.

Different types of real estate development

Real estate development can take many forms, depending on the intended use of the properties. Some common types of real estate development include:

-

Residential development: This involves creating housing units, such as single-family homes, townhouses, condominiums, or apartment complexes.

-

Commercial development: Commercial development focuses on creating spaces for businesses, such as office buildings, retail centers, hotels, or restaurants.

-

Industrial development: Industrial development involves building properties for manufacturing, warehousing, or logistics purposes.

-

Mixed-use development: This type of development combines residential, commercial, and sometimes even industrial elements in a single project, creating a community where people can live, work, and play.

-

Land development: Land development refers to transforming raw or undeveloped land into usable spaces by adding infrastructure, such as roads, utilities, or amenities.

Each type of real estate development comes with its own set of opportunities, challenges, and profit potential.

Factors Influencing Profitability

Market conditions

The profitability of real estate development is greatly influenced by market conditions. When there is high demand for properties in a particular location or sector, developers can charge higher prices, resulting in higher profit margins. Conversely, when market conditions are weak or there is oversupply, developers may face difficulties selling or renting their properties, leading to lower profitability.

Location

The location of a real estate development project is crucial in determining its profitability. Properties in prime locations, such as city centers or highly desirable neighborhoods, tend to command higher prices or rental rates. Additionally, properties that are close to amenities, transportation hubs, schools, or shopping centers are more attractive to potential buyers or tenants, further enhancing profitability.

Demand and supply

The dynamics of supply and demand play a significant role in the profitability of real estate development. Developers need to carefully assess the demand for certain types of properties in specific locations to ensure that there is sufficient demand to justify their investment. They also need to consider the supply of competing properties in the market and aim to differentiate their offerings to capture a share of the demand.

Costs and expenses

Managing costs and expenses is crucial for maintaining profitability in real estate development. Developers need to carefully budget for land acquisition, construction costs, financing expenses, marketing expenses, and ongoing maintenance or property management costs. Effective cost management and streamlined operations can significantly impact the overall profitability of a development project.

Benefits of Real Estate Development

Potential for high returns

Real estate development offers the potential for significant returns on investment. When executed successfully, developers can generate substantial profits by increasing the value of the properties they develop. This can be achieved through various means, such as renovating existing properties, adding desirable amenities, leveraging market trends, or identifying undervalued properties with the potential for appreciation.

Long-term wealth creation

Real estate development can be an effective long-term wealth creation strategy. By acquiring and developing properties strategically, investors can generate ongoing rental income or sales proceeds, which can be reinvested to fund future development projects or provide a stable source of passive income. Over time, the value of well-managed properties is likely to appreciate, further enhancing long-term wealth creation.

Diversification of investment portfolio

Investing in real estate development allows individuals to diversify their investment portfolios, reducing overall risk. Real estate typically has a low correlation with other asset classes, such as stocks or bonds, meaning its value often moves independently of these investments. By spreading investments across different types of properties, locations, or sectors, investors can mitigate risks and potentially achieve better overall returns.

Job creation and economic growth

Real estate development plays a crucial role in job creation and economic growth. The construction phase of development projects creates employment opportunities for architects, engineers, contractors, and construction workers. Once completed, properties contribute to the local economy by supporting businesses and attracting new residents or tenants. This, in turn, stimulates economic activity and can have a positive impact on the surrounding community.

Risks and Challenges

Volatility in the market

Real estate development is subject to market volatility and economic cycles. Changes in interest rates, inflation, or overall economic conditions can impact the profitability of development projects. Market downturns can lead to a decrease in property values or a decline in demand, making it more challenging for developers to sell or rent their properties at desired prices.

Political and regulatory risks

Real estate development is influenced by political and regulatory factors that can affect profitability. Government policies, zoning regulations, permitting processes, or environmental considerations can significantly impact the feasibility and timeline of a project. Changes in regulations or unexpected political decisions can introduce uncertainties and additional costs, potentially affecting the profitability of a development venture.

Unforeseen expenses and delays

Real estate development projects often face unforeseen expenses and construction delays, which can impact profitability. Issues such as construction material price fluctuations, labor shortages, or environmental challenges can result in cost overruns. Delays in obtaining permits or approvals can also lead to increased carrying costs, such as interest payments on loans, further affecting profitability.

Competition

Competition in the real estate development industry can be intense, particularly in highly desirable locations or sectors. Developers need to differentiate their projects and offer unique value propositions to attract buyers or tenants. Failure to differentiate or adequately anticipate market trends can result in higher marketing costs, longer selling or rental periods, or the need to adjust pricing, potentially impacting profitability.

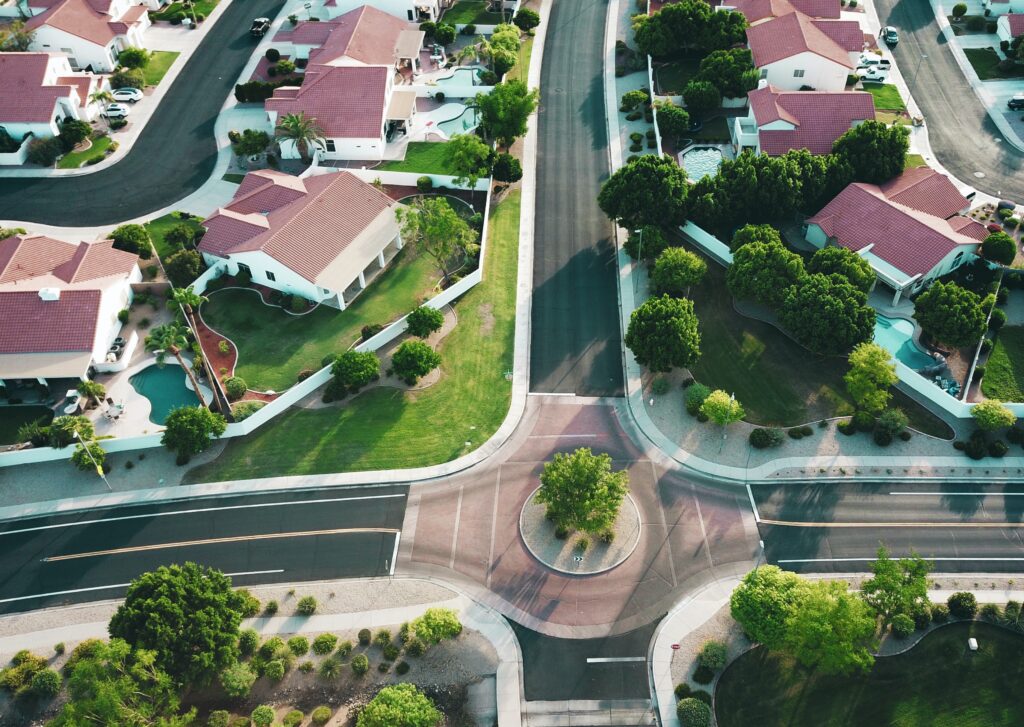

This image is property of images.unsplash.com.

Key Steps in Real Estate Development

Research and analysis

Thorough research and analysis are crucial in the initial stages of real estate development. Developers need to assess market conditions, demographic trends, and potential demand for specific types of properties. They should also analyze competition, evaluate potential risks, and determine the financial viability of the project.

Acquisition of land or property

Once the market has been analyzed, developers need to identify and acquire suitable land or existing properties for development. This involves negotiating purchase agreements, conducting due diligence, and securing financing if necessary.

Feasibility study

Before proceeding with a development project, developers must conduct a feasibility study to assess its viability. This includes evaluating financial projections, conducting a cost-benefit analysis, and considering potential risks and challenges. The feasibility study helps determine if the project aligns with the developer’s financial goals and if the expected returns justify the investment.

Obtaining financing

Real estate development projects often require significant capital investment. Developers need to secure financing from various sources, such as banks, private investors, or development agencies. This involves preparing detailed financial projections, presenting the project to potential lenders or investors, and negotiating favorable terms and conditions.

Permitting and approvals

Developers must navigate the permitting and approvals process, which involves obtaining necessary permits, licenses, or zoning approvals from local authorities. This can be a complex and time-consuming process, requiring compliance with local regulations and addressing any environmental, infrastructure, or community concerns.

Design and planning

The design and planning phase involves working with architects, engineers, and designers to create the blueprint for the development project. Developers need to consider factors such as functionality, aesthetics, sustainability, and cost efficiency. Effective design and planning contribute to the overall attractiveness and success of the project.

Construction

Construction is a critical phase in real estate development. Developers must oversee the building process, ensuring quality control, adherence to timelines, and cost management. This involves coordinating with contractors, suppliers, and other professionals involved in the construction process.

Marketing and sales

Once the development project is completed, developers need to market and sell the properties or lease them to tenants. Effective marketing strategies, pricing, and staging can help attract potential buyers or tenants and enhance profitability.

Property management

For developers who choose to hold properties for rental income, effective property management is crucial for ongoing profitability. This includes tenant screening, lease management, property maintenance, and ensuring optimal occupancy rates.

Strategies for Profitable Development

Identifying emerging markets

Identifying emerging markets with growth potential can be a profitable strategy in real estate development. Analyzing demographic trends, economic indicators, and urbanization patterns can help developers identify locations where demand for certain types of properties is expected to rise. By being early movers in emerging markets, developers can benefit from lower land prices and the potential for significant appreciation.

Targeting high-demand areas

Focusing on high-demand areas is another strategy for profitable development. This involves selecting locations that have a strong demand for housing or commercial spaces due to factors such as population growth, job opportunities, or lifestyle preferences. Properties in high-demand areas tend to experience higher demand, shorter selling or rental periods, and potential price appreciation.

Smart investment decisions

Making smart investment decisions is crucial for profitable real estate development. Developers need to carefully analyze potential returns on investment, taking into account factors such as acquisition costs, development costs, ongoing expenses, and potential market appreciation. Conducting thorough due diligence, leveraging market research, and employing financial modeling techniques can help guide investment decisions and increase the chances of profitability.

Effective project management

Effective project management is essential for controlling costs, meeting timelines, and minimizing risks in real estate development. Developers need to assemble a skilled team of professionals, including architects, contractors, project managers, and legal advisors. Clear communication, regular progress monitoring, and efficient resource allocation contribute to successful project execution and ultimately, the profitability of the development venture.

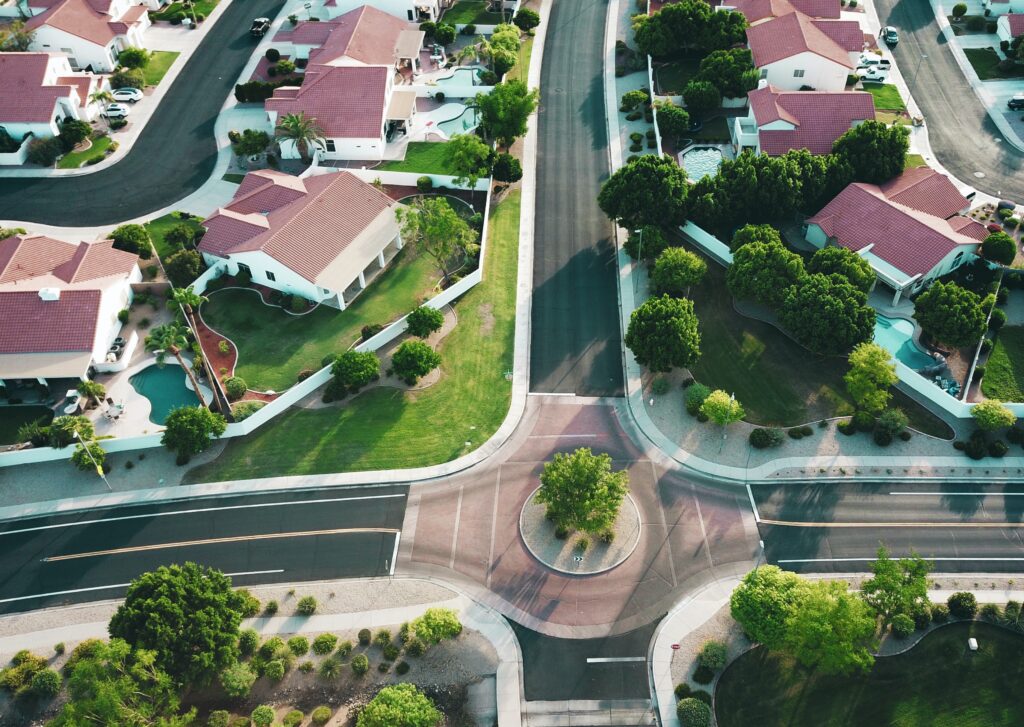

This image is property of images.unsplash.com.

Building Partnerships and Networks

Collaboration with architects, contractors, and designers

Building strong relationships with architects, contractors, and designers is crucial for successful real estate development. Collaborating with experienced professionals who understand the intricacies of the industry can lead to better design solutions, cost efficiencies, and adherence to construction timelines. Establishing long-term partnerships with trusted partners can also provide developers with a competitive advantage in the market.

Establishing relationships with investors and lenders

Developers need to establish relationships with investors and lenders to secure the necessary financing for development projects. Cultivating trust and credibility in the investment community can help developers access capital at favorable terms and attract potential investors for future projects. Maintaining open lines of communication and providing transparent financial reporting are key to building long-term relationships with investors and lenders.

Networking with industry professionals

Networking with industry professionals, such as real estate brokers, property managers, or industry associations, can provide valuable insights and opportunities for real estate developers. Attending industry events, joining professional organizations, or participating in real estate forums allows developers to stay updated on market trends, learn from industry experts, and potentially form partnerships or collaborations that can enhance profitability.

Key Success Factors

Thorough market research

Thorough market research is a key success factor in real estate development. By understanding market conditions, demographic trends, and demand-supply dynamics, developers can make informed decisions about location, property types, and pricing strategies. This knowledge helps mitigate risks and ensures that the development project aligns with market demand, maximizing profitability.

Strong financial planning

Strong financial planning is essential for successful real estate development. Developers need to carefully evaluate the financial feasibility of a project, taking into account acquisition costs, development costs, ongoing expenses, financing costs, and potential returns on investment. Developing accurate financial projections, assessing the sources of funding, and implementing sound financial management practices contribute to overall profitability.

Experienced team

Having an experienced team is critical for the success of real estate development projects. Developers need to assemble a skilled team of professionals, including architects, engineers, contractors, legal advisors, property managers, and marketing professionals. Leveraging the expertise and experience of the team members helps ensure efficient project execution, compliance with regulations, and optimal decision-making, all of which contribute to profitability.

Adaptability to changing market trends

Adaptability to changing market trends is a crucial success factor in real estate development. Developers need to stay updated on evolving market conditions, technology advancements, and consumer preferences. Being able to adjust strategies, repurpose properties, or leverage emerging trends can ensure that development projects remain competitive and profitable in a rapidly changing market.

Real Estate Development vs Other Investment Options

Comparison with stocks and bonds

Real estate development offers distinct advantages and disadvantages compared to other investment options, such as stocks and bonds.

Advantages of real estate development include:

- Tangible asset: Real estate is a physical asset that investors can see and touch, providing a sense of security.

- Potential for leverage: Real estate investments can be financed with borrowed funds, allowing investors to amplify returns.

- Cash flow: Rental income from real estate properties can provide a consistent cash flow stream.

- Potential for appreciation: Well-chosen properties in desirable locations have the potential for long-term appreciation in value.

Disadvantages of real estate development include:

- Illiquidity: Real estate investments can be relatively illiquid, meaning they cannot be easily sold or converted into cash.

- High upfront costs: Real estate development requires significant capital investment, making it less accessible to some investors.

- Market volatility: Real estate markets can experience fluctuations in value, making it subject to market cycles and economic conditions.

Investors need to carefully consider their investment goals, risk tolerance, and time horizon when choosing between real estate development and other investment options.

Case Studies of Successful Real Estate Ventures

Examples of profitable real estate developments

There are numerous examples of successful real estate development ventures that have proven to be highly profitable. One such example is the redevelopment of the High Line in New York City. The High Line was once an abandoned elevated railway, but visionary developers transformed it into a stunning elevated park and trail, attracting millions of visitors and contributing to the revitalization of the surrounding neighborhood. The project not only generated significant returns for the developers but also had a positive impact on the local economy and community.

Another example is the development of the Hudson Yards in Manhattan. This massive mixed-use development project transformed a former rail yard into a vibrant neighborhood with residential towers, office buildings, retail spaces, and cultural venues. Hudson Yards has become a magnet for businesses and residents, attracting global attention and generating substantial profits for the developers and investors involved.

These case studies highlight the potential for profitability in real estate development when executed with vision, innovation, and careful consideration of market demand and community needs.

Environmental and Social Considerations

Sustainability and green building practices

In recent years, there has been a growing emphasis on sustainability and green building practices in real estate development. Developers are increasingly incorporating eco-friendly design elements, energy-efficient technologies, and sustainable materials into their projects. These practices not only contribute to reducing environmental impact but also appeal to environmentally conscious buyers or tenants. Additionally, green buildings often have lower operating costs and can attract government incentives, further enhancing profitability.

Community impact and social responsibility

Real estate developers have a responsibility to consider the impact of their projects on the surrounding community. They should aim to create developments that enhance the quality of life for residents, preserve cultural heritage, and contribute to the overall well-being of the community. By incorporating community spaces, supporting local businesses, or providing affordable housing options, developers can build positive relationships, enhance their reputation, and potentially increase the profitability of their projects.

Conclusion

Real estate development presents significant opportunities for profitability when approached strategically and with careful planning. It offers the potential for high returns, long-term wealth creation, and diversification of investment portfolios. Successful real estate development projects can generate substantial profits, contribute to job creation and economic growth, and positively impact communities. However, real estate development also comes with risks and challenges that must be navigated. By understanding market conditions, building strong partnerships, implementing effective strategies, and considering environmental and social factors, investors can maximize the profitability of their real estate development projects.